Ns payroll deductions calculator

Use this calculator to help you determine the impact of changing your payroll deductions. This works out to be 1627 per biweekly paycheck.

Fast Easy Affordable Small Business Payroll By ADP.

. Table of provincial tax brackets rates in Nova Scotia for 2022. 2022 Payroll Deduction Table for Nova Scotia CFIB To help you out with payroll deductions weve prepared a summary chart including all the 2021 rates for CPP EI taxes etc. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2021.

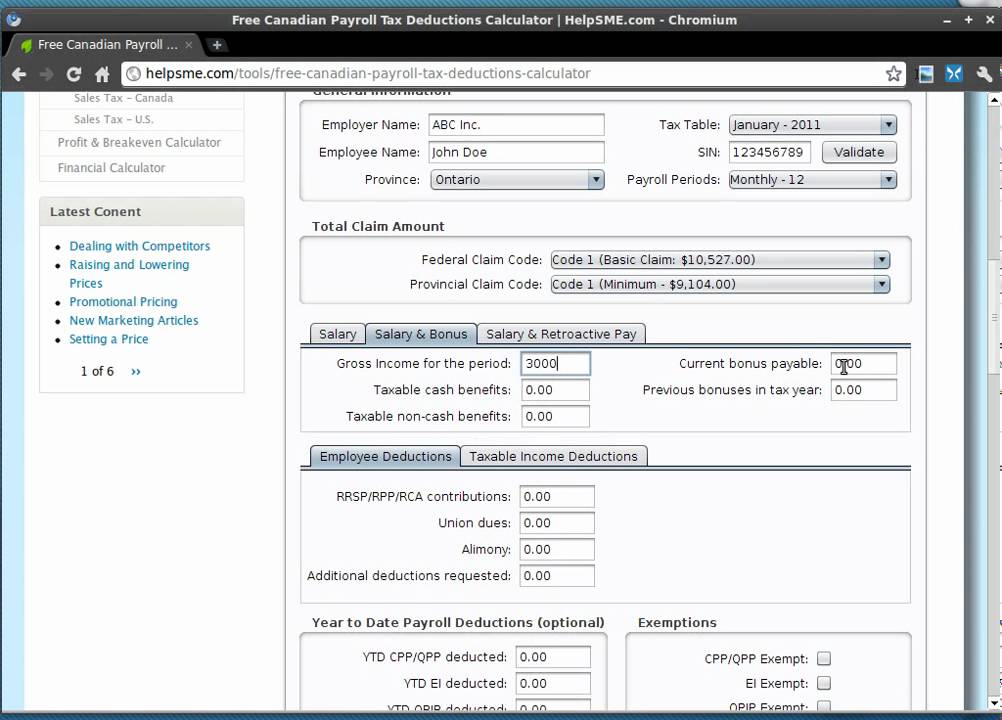

The federal tax deduction for 1020 weekly under claim code 1 is 10060. How to use a Payroll Online Deductions Calculator. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

Baca Juga

You can enter your current payroll information and deductions and then compare them to your. Use this calculator to help you determine the impact of changing your payroll deductions. The average income in Nova Scotia for adults over the age of 16 is 42300.

If you need more help contact your tax. 8 481 enhancement or less. Income Tax calculations and RRSP factoring for 202223 with.

In Nova Scotia taxes are paid on graduated rates which means that as your taxable income increases your tax-rate and tax liability increases. Ad Learn How To Make Payroll Checks With ADP Payroll. Get 3 Months Free Payroll.

Get 3 Months Free Payroll. Ad Easy To Run Payroll Get Set Up Running in Minutes. 8 481 enhancement to.

Get 3 Months Free Payroll. The tool then asks you. Payroll Deductions Supplementary Tables - Nova Scotia.

The federal Basic Personal Amount. Get 3 Months Free Payroll. Use this simplified payroll deductions calculator to help you determine your net paycheck.

This guide uses plain language to explain the most common tax situations. You can enter your current payroll information and deductions and then compare them to your. Salary commission or pension.

Fast Easy Affordable Small Business Payroll By ADP. Taxes Paid Filed - 100 Guarantee. Please select a payroll period to access specific 2022 salary comparison for income in Nova Scotia in the 202223 Tax Year.

Youll pay a tax rate of 879 on the first. To determine Saras provincial tax deductions you use the weekly provincial tax deductions table. Gross taxable income brackets Nova Scotia.

Ad Learn How To Make Payroll Checks With ADP Payroll. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. You can use the calculator to compare your salaries between 2017 and 2022.

The Nova Scotia Income Tax Salary Calculator is updated 202223 tax year. You first need to enter basic information about the type of payments you make. This publication is the Payroll Deductions Tables for Nova Scotia effective January 1 2022.

For example if you earn 2000week your annual income is calculated by. The federal tax deduction for 1018 weekly under claim code 1 is 10280. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Each salary calculator provides detailed tax and payroll. Form TD1-IN Determination of Exemption of an Indians Employment Income. This compares to an average of 48700 and 38800 median in.

The calculator is updated with the tax rates of all Canadian provinces and. To determine Saras provincial tax deductions you use the weekly provincial tax deductions table. Nova Scotia Salary Examples.

It reflects some income tax changes recently announced which if enacted by the applicable.

Avanti Gross Salary Calculator

Canadian Payroll Calculator Discounts Deals 53 Off Greenagetech Com

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Payroll Deduction Remittances In Canada Everything You Need To Know Paymentevolution

Pay Wages Canada Nanny Helper

How To Do Payroll In Canada A Step By Step Guide

Everything You Need To Know About Running Payroll In Canada

Find The Right App Microsoft Appsource

Breakdown Of Canadian Payroll Taxes For Us Companies

2

Avanti Income Tax Calculator

Online Payroll Calculator Payroll Connected

Online Payroll Calculator Payroll Connected

How To Calculate Payroll Taxes Methods Examples More

Find The Right App Microsoft Appsource

Canadian Payroll Vs U S Payroll What S The Difference Updated 2020

Standard Deductions Youtube